Missing deadlines can lead to penalties, so here’s what you need to know:

1. Company/LLP Compliance (MCA)

- Annual Return (Form MGT-7) – Filed within 60 days of AGM

- Financial Statements (AOC-4) – Due within 30 days of AGM.

- DIR-3 KYC – Mandatory for directors every year.

- Open a Business Bank Account – Separate finances for compliance.

2. GST Compliance

- Monthly/Quarterly Returns (GSTR-1, GSTR-3B) – Sales & tax payment details.

- Annual Return (GSTR-9) – Yearly reconciliation by Dec 31.

3. Income Tax Filings

- ITR for Businesses – Due by July 31 (individuals/firms) or Sept 30 (companies).

- Tax Audit (Sec 44AB) – Required if turnover exceeds ₹1 crore (₹50 lakh for professionals).

4. TDS/TCS Returns

- Quarterly TDS Returns (Form 24Q, 26Q, 27Q) – Due on 31st Jan, 31st May, 31st July, 31st Oct.

- TCS Returns (Form 27EQ) – For businesses collecting tax at source.

5. Labour & Other Compliances

- EPF/ESI Returns – Monthly contributions & filings.

- MSME Form I (Half-Yearly) – For companies with MSME vendors.

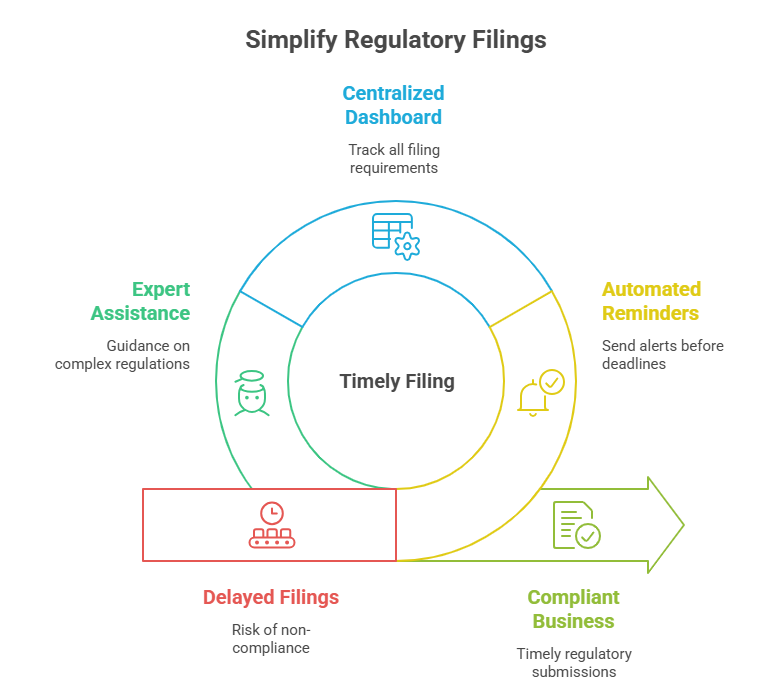

Why Timely Filings Matter?

- Avoid heavy penalties & interest.

- Maintain good standing with authorities.

- Smooth loan approvals & audits.

For expert help on regulatory filings, contact us and visit our website anytax.in.